The truth behind the 5 biggest myths about TCA

Despite the obvious benefits, there are still misconceptions preventing businesses from implementing TCA.

We’ve helped our clients cut their FX costs by 88.15% on average, avoiding hidden costs & reduced execution quality.

Find out if you are overpaying with our free & independent Transaction Cost Analysis and gain full FX transparency.

88.15%

saving on average

15

tier 1 counterparty banks

$543bn+

annual FX Volume**The benefits of a Transaction Cost Analysis with MillTechFX

Full FX transparency

Full visibility of hidden costs in your FX rates

Performance management

Benchmark FX costs against industry standards

Enhance FX risk management

Identify FX risks and inefficiencies

Optimise your FX execution

Assess and improve trading times, sizes, and methodsIndependent vs. In-house TCAs

Third-party verification of FX costs

Access to broader market data and benchmarks

Analysis free from internal biases and conflicts of interests

Allows your team to concentrate on core business activities

Why global businesses & fund managers have chosen us

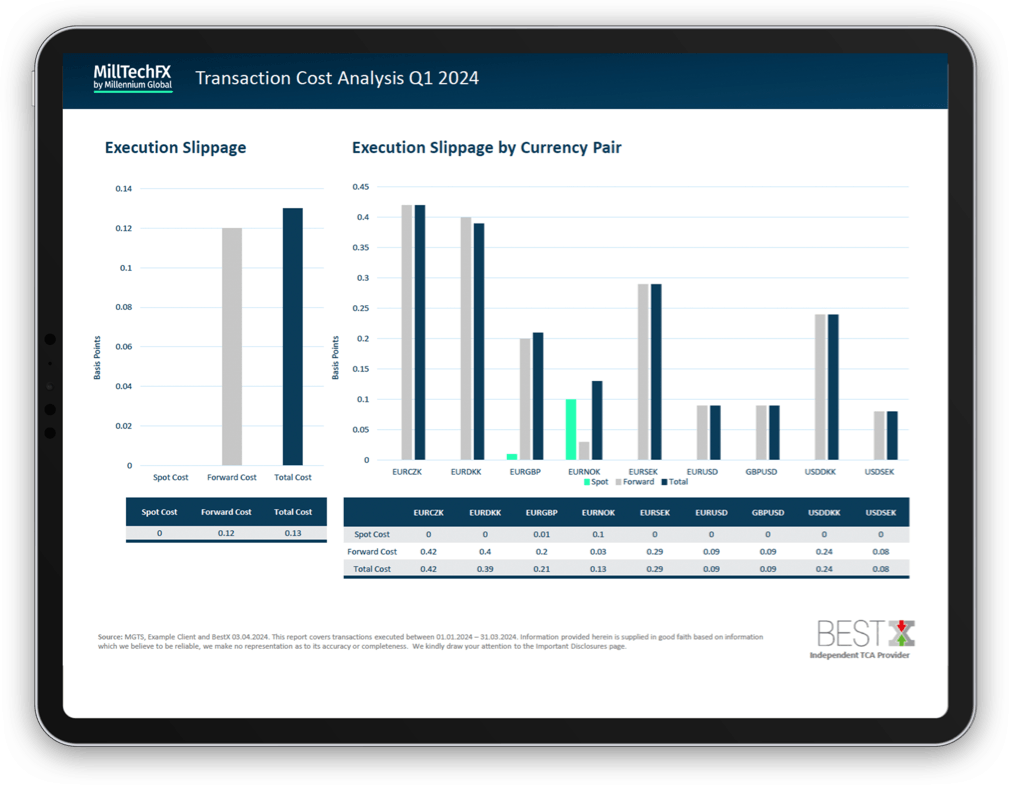

Independent third-party analysis

Impartial analysis from our partner BestX

FX specialist consultation

Providing insights and feedback on execution quality

Customised Report

Tailored TCA report that meets your specific needs

Compliance approved

Adheres to FX regulatory standards with reporting for audit trailsFree independent TCA through our partner BestX, revealing hidden costs and inefficiencies

Free quarterly TCA’s through our partner BestX, serving as an independent audit of costs

Objectively compare the cost and quality of your current FX execution with MillTechFX

Observe historical trends enabling you to identify patterns over time, providing a clearer picture of long-term performance

Despite the obvious benefits, there are still misconceptions preventing businesses from implementing TCA.

Despite businesses regularly transacting in FX, many have poor visibility on what the costs of these transactions are and suffer from hidden charges.

Access to competitive pricing and operational efficiency will always be critical factors for private equity firms when it comes to trading currencies...

Simply fill in both fields below and one of our friendly experts will be in touch shortly to discuss your requirements.