Independent FX-as-a-Service enabling best execution

Automate your currency management with access to our comparative FX marketplace & end-to-end service model for finance, operations, and treasury teams.

Multi-award winning FXaaS pioneer with fiduciary heritage

As part of one of the largest currency management groups, we are proud to deliver a fairer, more transparent and cost-effective FX execution and hedging solution, building on decades of experience of Millennium Global.

Years of Heritage

Group Hedged Assets*

Annual FX Volume**

up to

Counterparty Banks

Years of Heritage

Group Hedged Assets*

Annual FX Volume**

up to

Counterparty BanksMillTechFX Awards

FXaaS is independent, transparent & tech-enabled

Save costs

Access our preferential FX rates with banks for spot, forwards, rolls and NDFs

Market access

Benefit from our established network of up to 15 Tier 1 counterparty banks

Save time

Express ISDA onboarding and end-to-end execution, settlement and trade reporting

No margin-hedging*

Reduce cash-drag on FX forwards without jeopardising best execution

Total cost transparency

Embedded third-party Transaction Cost Analysis (TCA) and independent oversight

Best Execution

Achieve the best available FX rate from up to 15 Tier 1 counterparty banks

We are more than just a platform

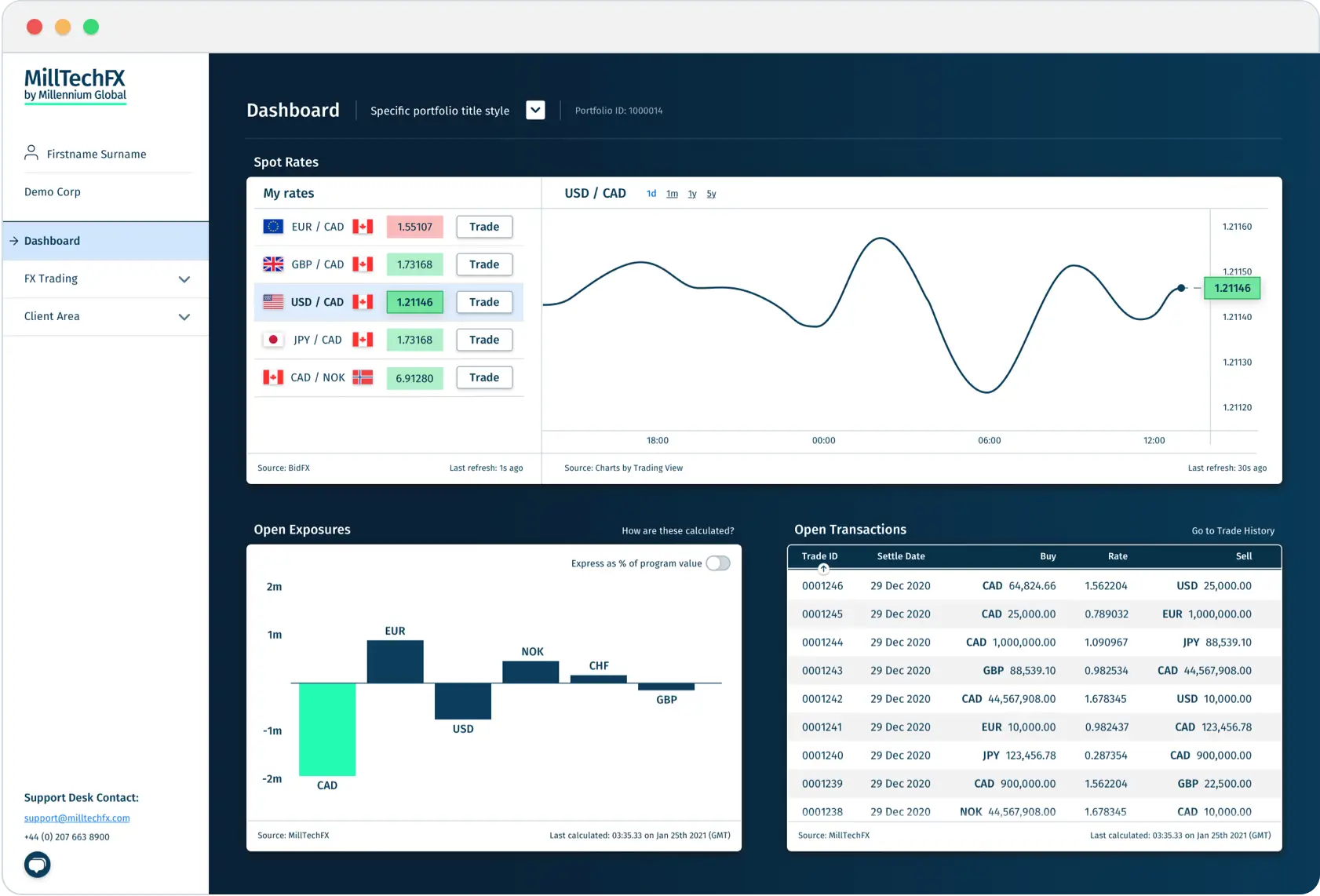

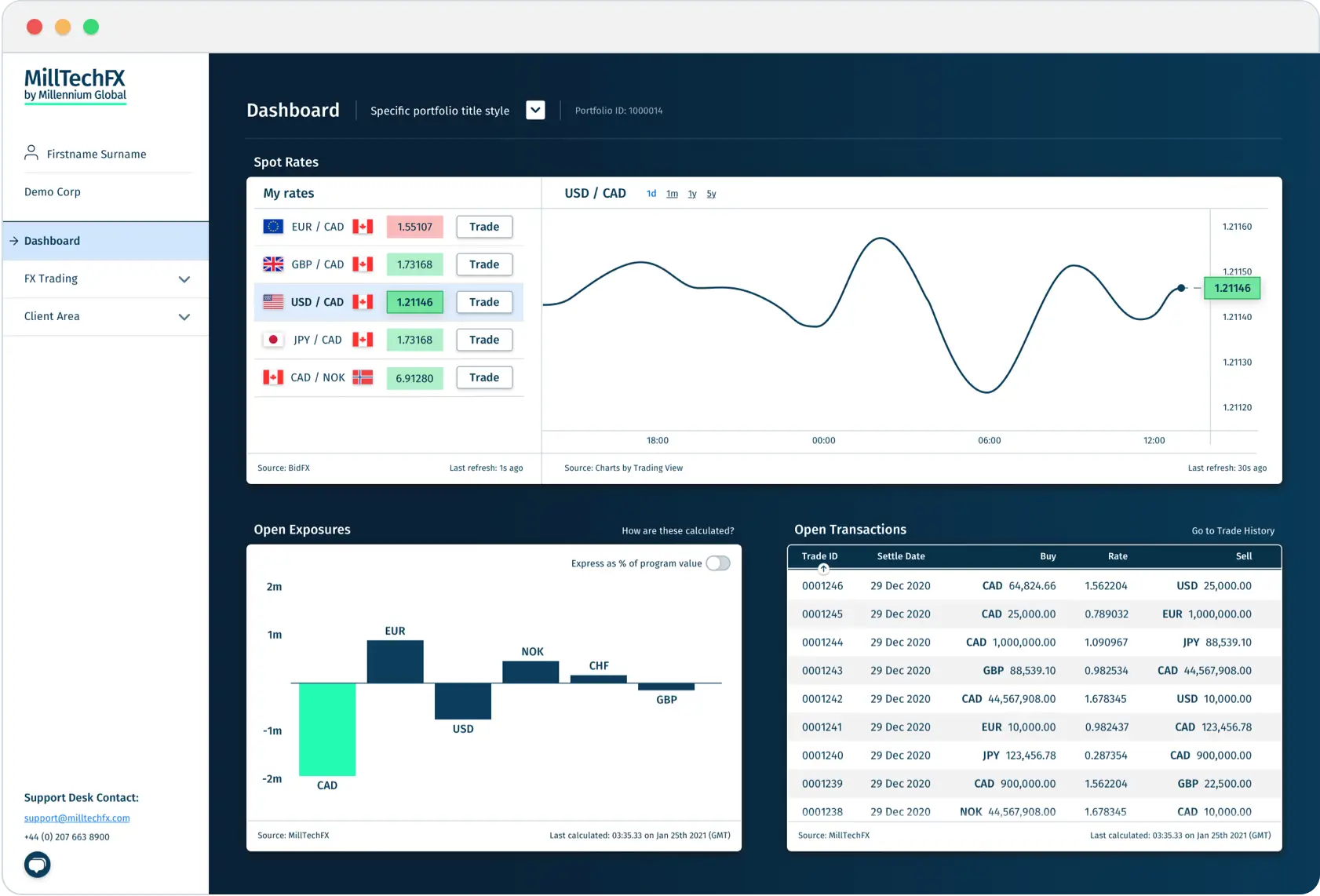

Easy to use and cyber secure, our platform is designed with the user in mind to streamline your operational workflows.

Transaction Cost Analysis

= FX cost audit

We offer third-party Transaction Cost Analysis (TCA) via our partner BestX, which provides clients with a regular cost audit of their FX transactions

We are open for business globally

We are a regulated business and provide services to clients in: